Building Optimised Portfolios

Investors have multiple concerns. For example, you might be new to investment and not know how to choose the right assets out of the thousands of available options. Or you might already have a portfolio but be concerned about how well it is optimised. You might also build a portfolio yourself but need help choosing the best assets from your Asset Cart and allocating money between assets to get the best possible portfolio. Piocaro can help you with any of these cases.

Model Portfolios

Let us assume you are an investor who does not have much expertise with investing. You know your investment goal but need more guidance to choose the right investments. To help you invest effectively Piocaro offers Model Portfolios.

With model portfolios, you do not have to research and choose individual assets. Instead, you select an already designed portfolio that best meets your target return and risk.

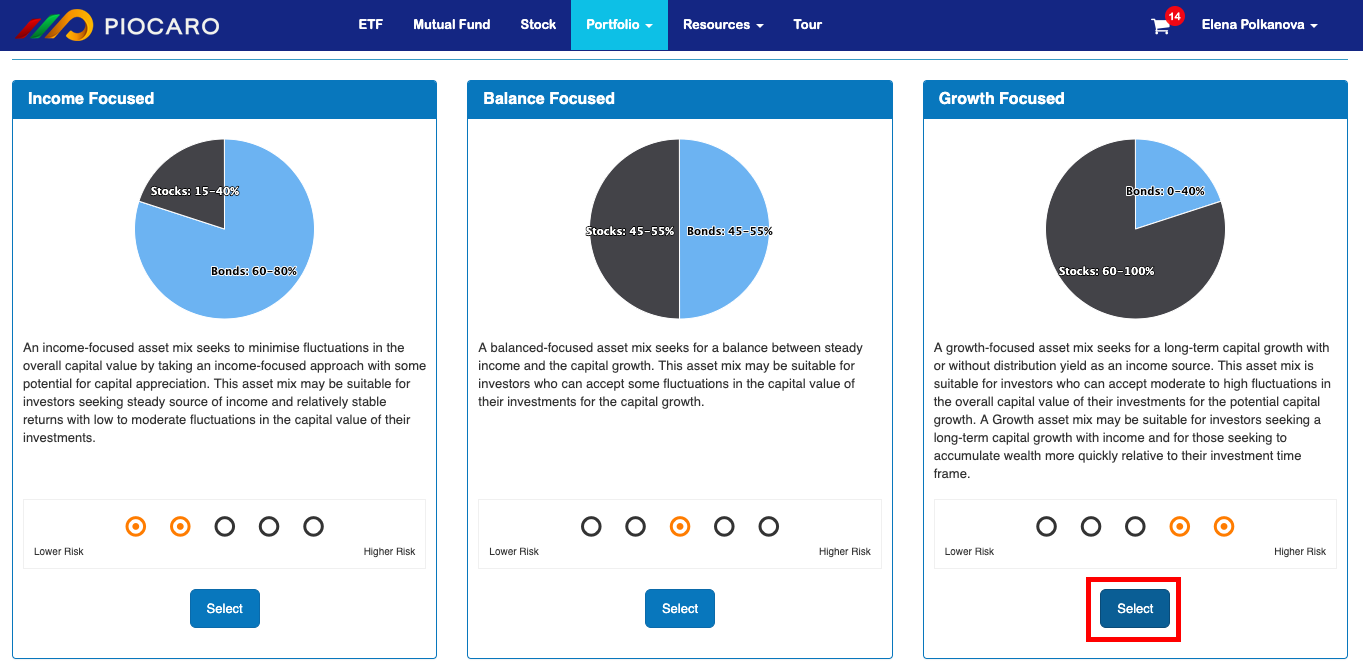

Model portfolios are built to address three main investment objectives: Income, Balance and Growth. They provide different combinations of higher risk and reward assets (growth assets) and lower risk and reward assets(defensive assets).

-

Income - Bonds 60%-80%, Stocks 15-40%. This asset mix might be suitable for investors seeking steady source of income and relatively stable returns with low to moderate fluctuations in the capital value of their investments.

-

Balance - Bonds 45%-55%, Stocks 45-55%. This mix offers a balance between steady income and the capital growth. Might be suitable for investors who can accept some fluctuations in the capital value of their investments in exchange for the capital growth.

-

Growth - Bonds 0%-40%, Stocks 60-100%. A Growth asset mix might be suitable for investors seeking a long-term capital growth and for those seeking to accumulate wealth more quickly relative to their investment time frame. Investors should be ready to accept moderate to high fluctuations in the overall capital value of their investments.

-

On the main page, click Portfolio and select Model Portfolios from the dropdown menu.

- Click Select to select the portfolio type you want: Income Focused, Balance Focused or Growth Focused.

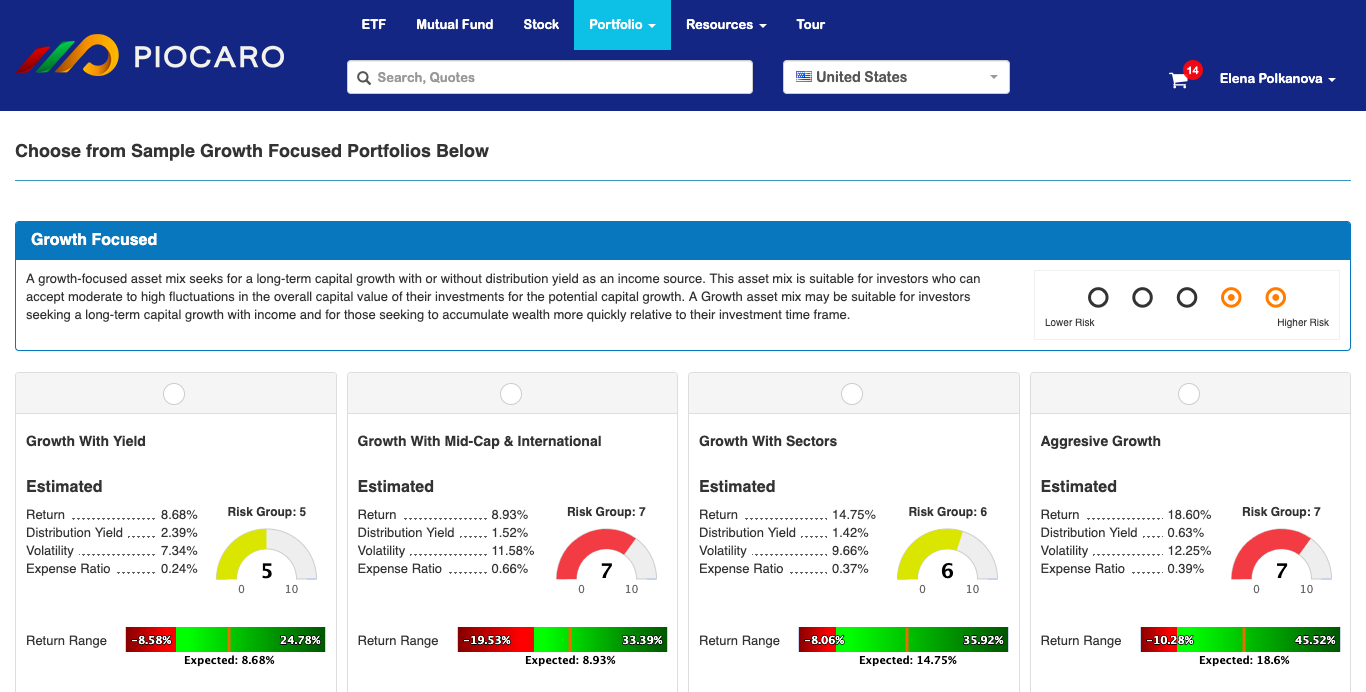

For each portfolio type there are several portfolios, each with different characteristics.

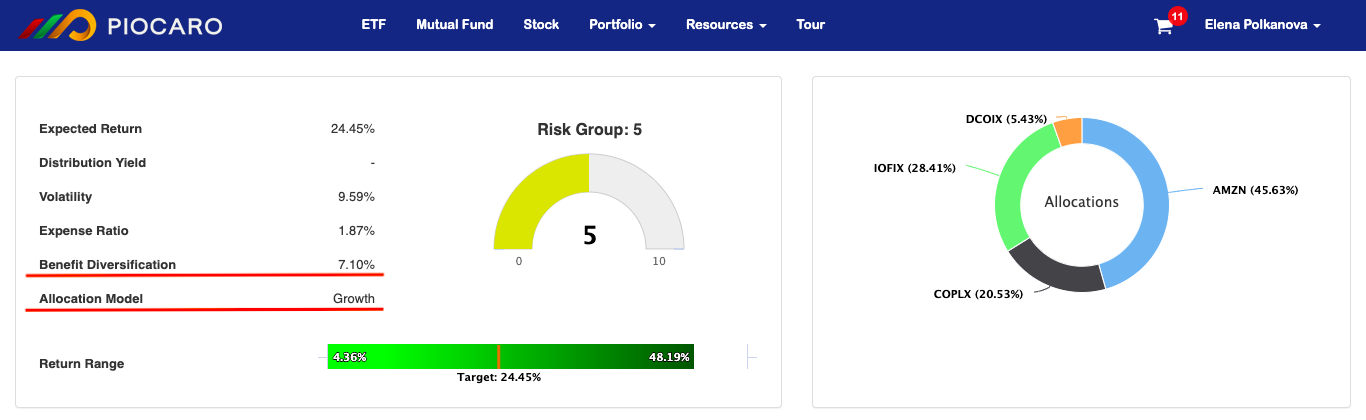

Each portfolio provides the following estimates:

-

Return - Estimated gain or loss generated on your invested capital.

-

Distribution Yield - Distributions are a portion of the profit made by a fund, distributed as income payments to investors. Similar to a dividend that is paid to company shareholders, you might receive distributions if you invest in mutual funds or ETFs.

-

Volatility - Estimated fluctuations in the value of your investment.

-

Expense Ratio - The portion of your investment paid as fees to a fund.

-

Return Range - Estimated range of values for future returns(98% probability).

-

Risk Group - Risk Group indicates portfolio overall risk on a scale of 1 to 10. 1 denotes an investment with the lowest risk and 10 with the highest risk. Piocaro assigns a Risk Group score based on the composition of different asset types and classes in a portfolio.

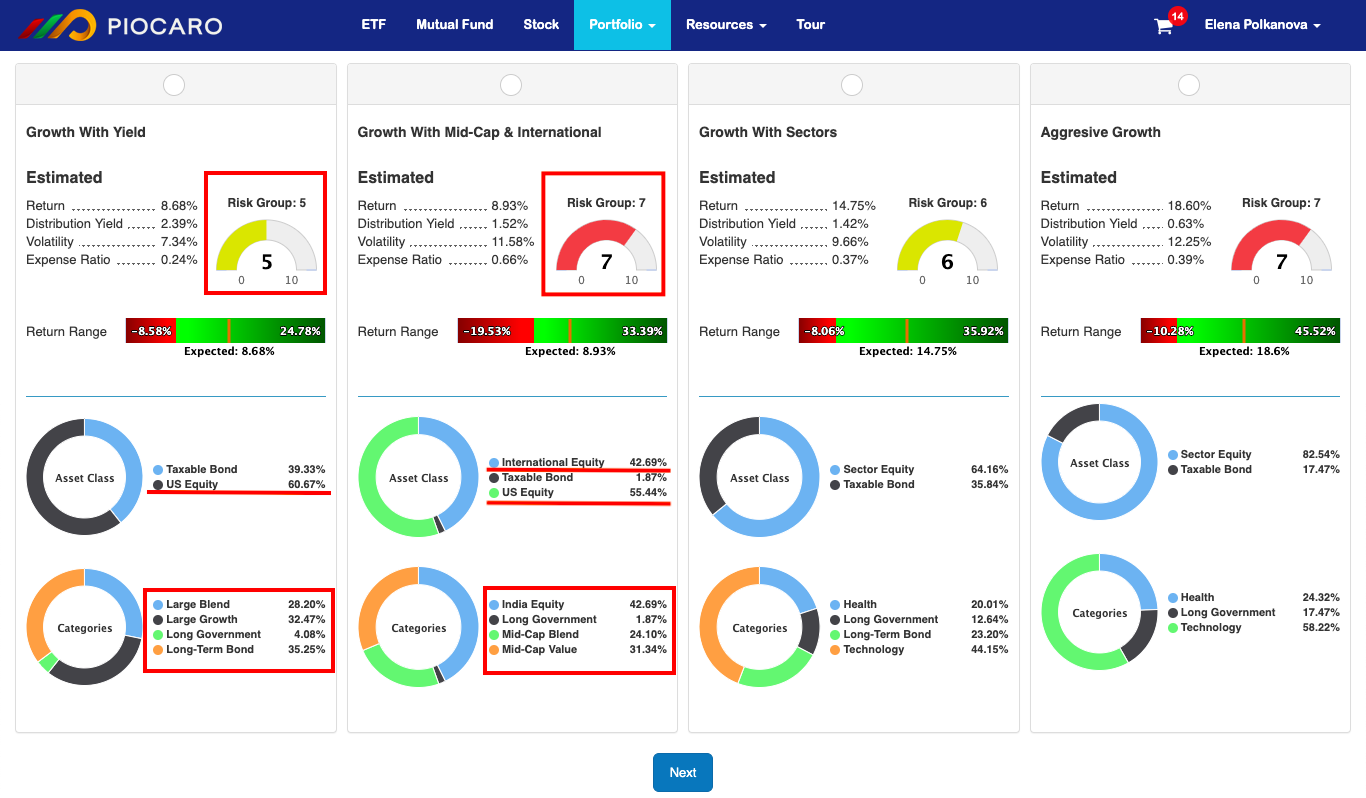

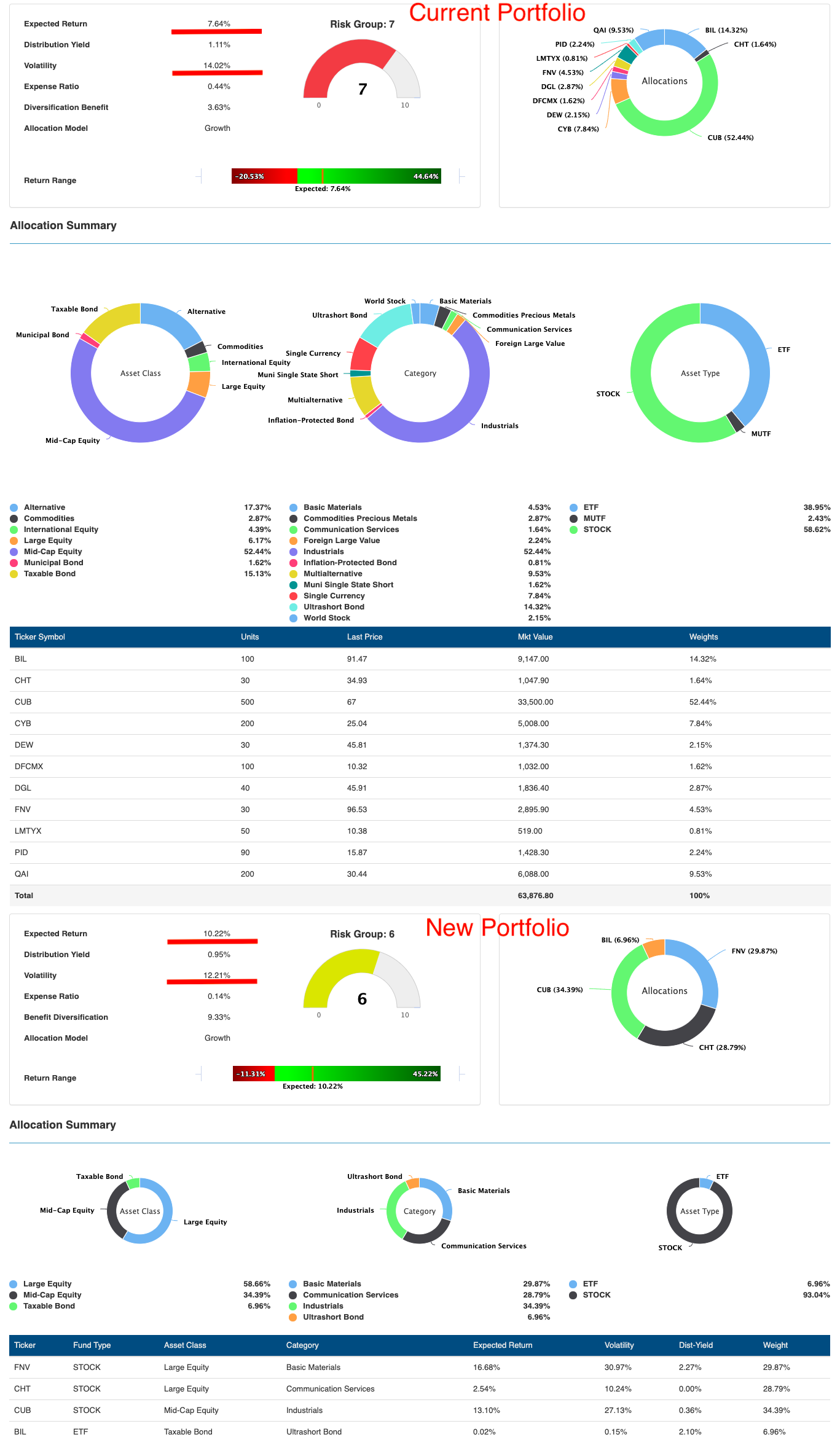

For example, let's compare a portfolio with a risk group of 5 to a portfolio with a risk group of 7. In the portfolio rated as 5, 60.67% of investment value is allocated to equity. In the portfolio rated as 7 the total amount of equity is over 98%, while only 1.87% is allocated to "safer" assets such as bonds. The portfolio rated as 7 also includes both international and US equity, witch might also increase risk due to potential currency rate fluctuations.

A portfolio with a higher proportion of equity will have a higher Risk Group value.

The Categories chart shows that equity in the portfolio with the Risk Group 5 belongs to Large Cap category, while the Risk Group 7 portfolio is made up of Mid-Cap equity, which is considered riskier.

Large-Cap stocks are typically less risky that Mid-Cap stocks because large companies have more resources and therefore are less vulnerable to negative market events.

To save your portfolio:

-

Click Next and type in your Portfolio Name, Description and the Amount to Invest.

-

Click Save and review a summary of your investment with return targets, risk levels, and asset allocations.

-

Click Download to obtain a summary of your investment portfolio. This is a PDF document that highlights the key features of your portfolio, and an Excel spreadsheet with asset allocations to send to your broker.

Portfolio Analyser

Portfolio Analyser is an essential tool for investors who already have a portfolio but want to know if it is optimal, and how it can be improved.

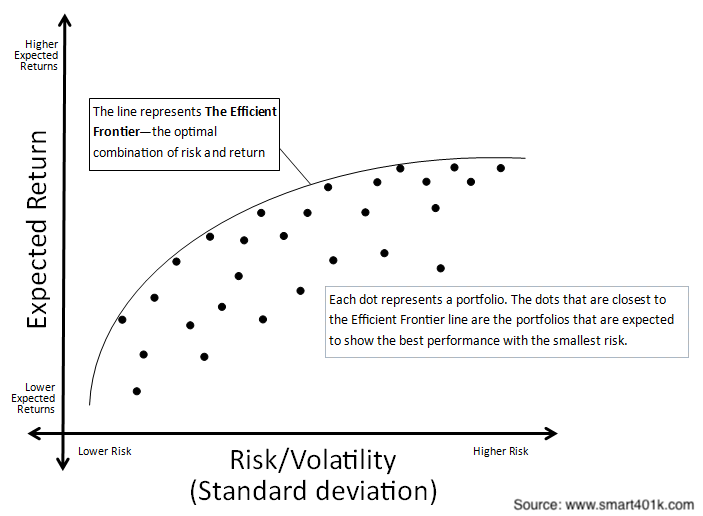

Optimal portfolios are those that offer the best possible return for a given level of risk. All investors seek optimal portfolios because they offer the best risk-return trade-off. A portfolio of assets that carries more risk than it should to achieve a particular rate of return is called suboptimal.

To check if your existing portfolio compensates you with enough return for the risk it bears:

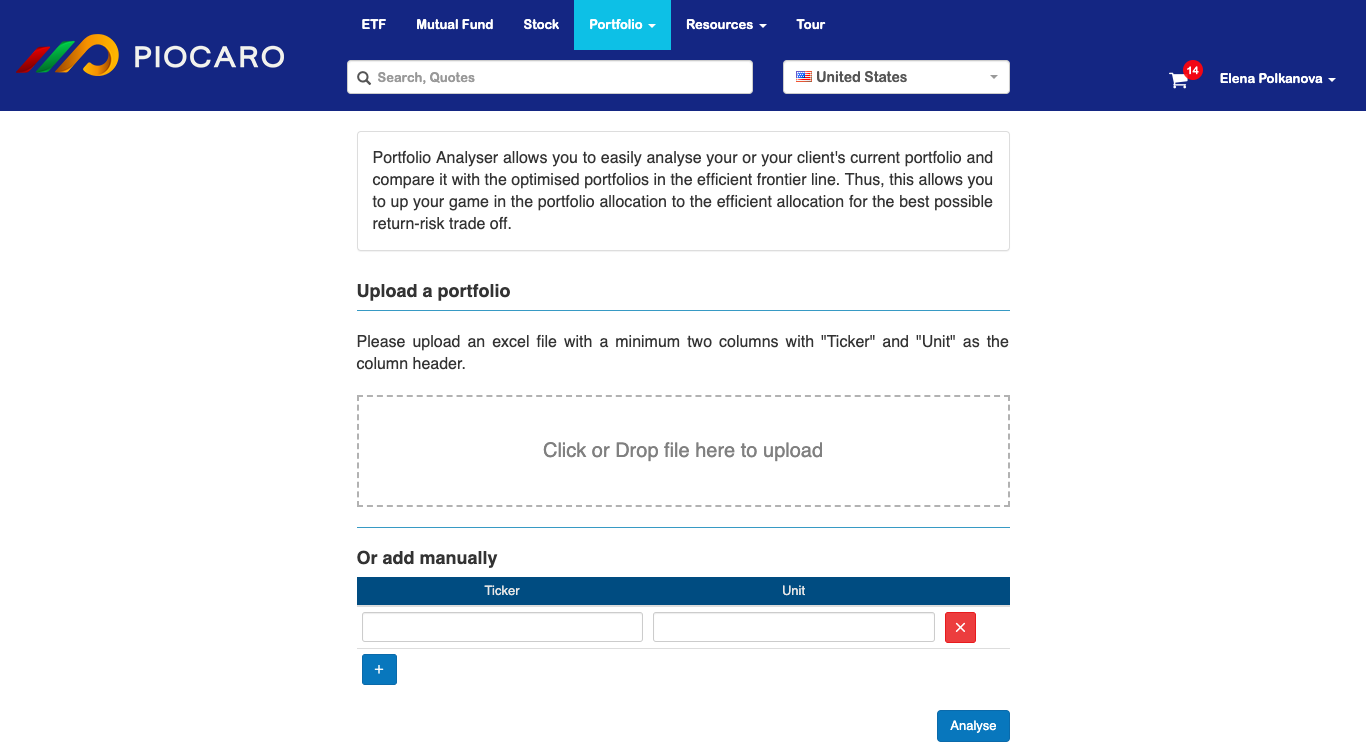

1. On the main page, click Portfolio and select Portfolio Analyser from the dropdown menu.

2. Upload an Excel file with a minimum of two columns, and with "Ticker" and "Unit" as the column headers. Alternatively, you can manually enter your portfolio assets and allocations.

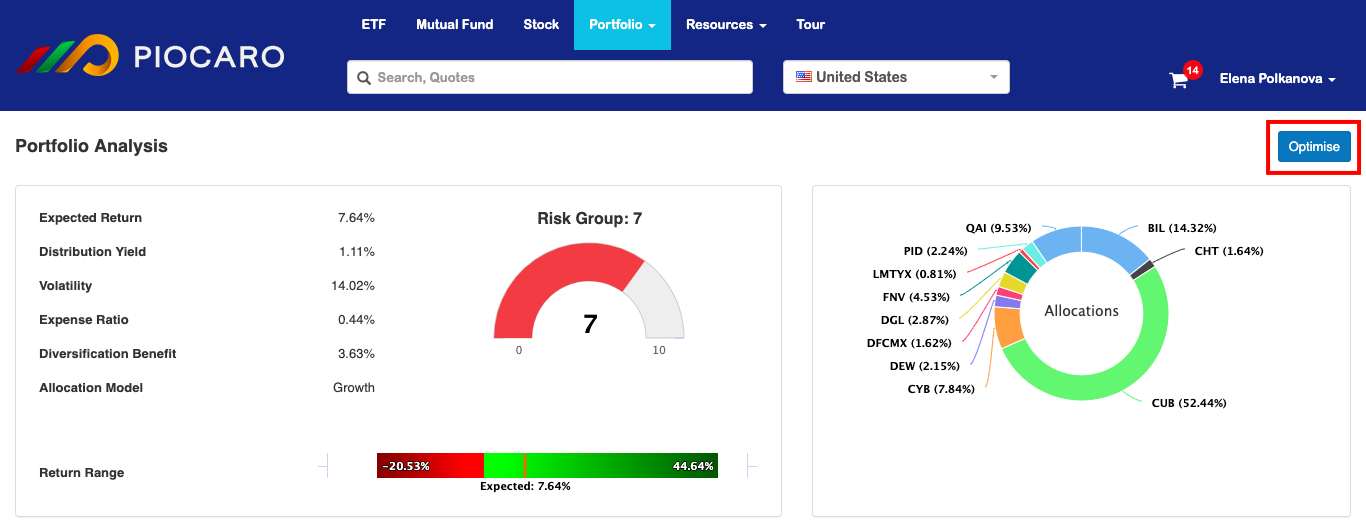

After uploading your file or manually entering asset allocations, click Analyse. An infographic summary of your portfolio is displayed.

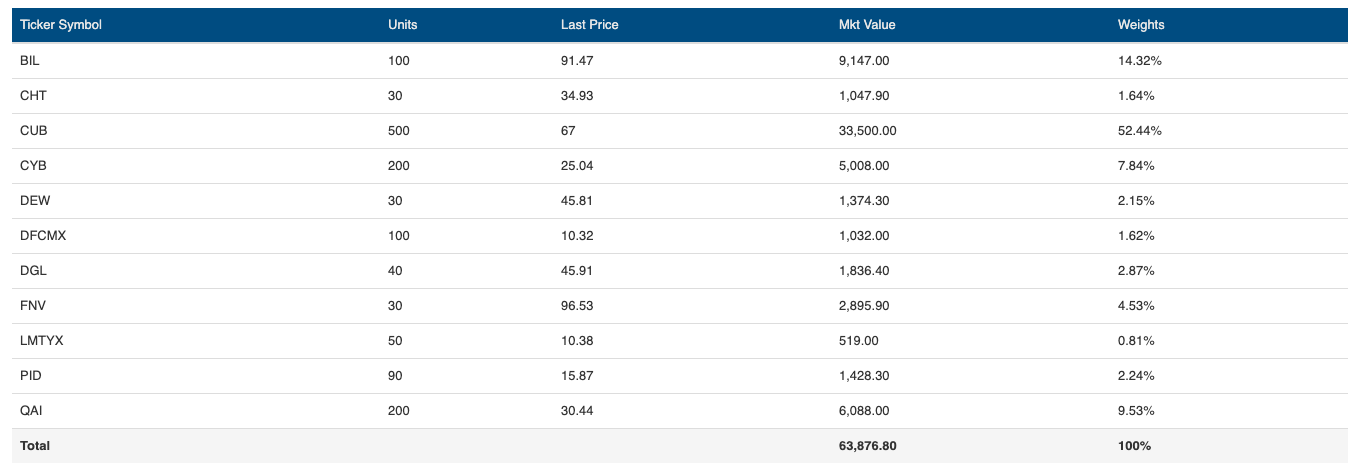

Based on the number of units of each asset and their current prices, Piocaro calculates the market value of your investment and assets weights.

Click Optimise to see how these allocations can be improved.

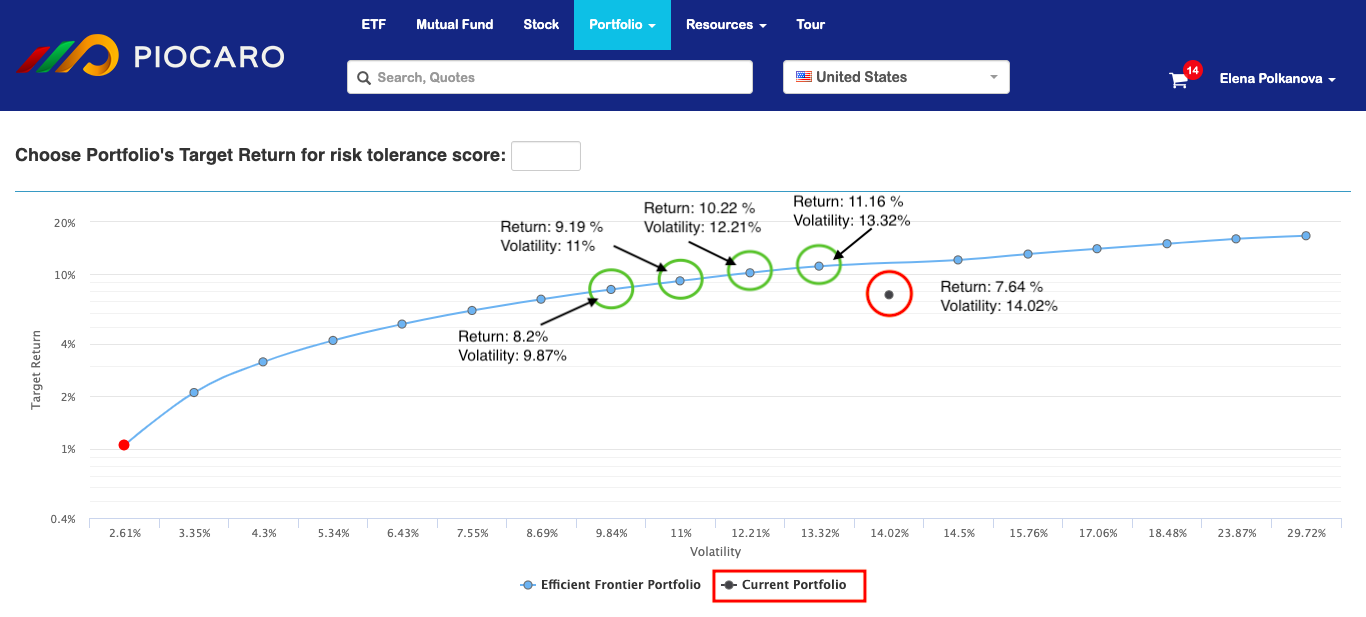

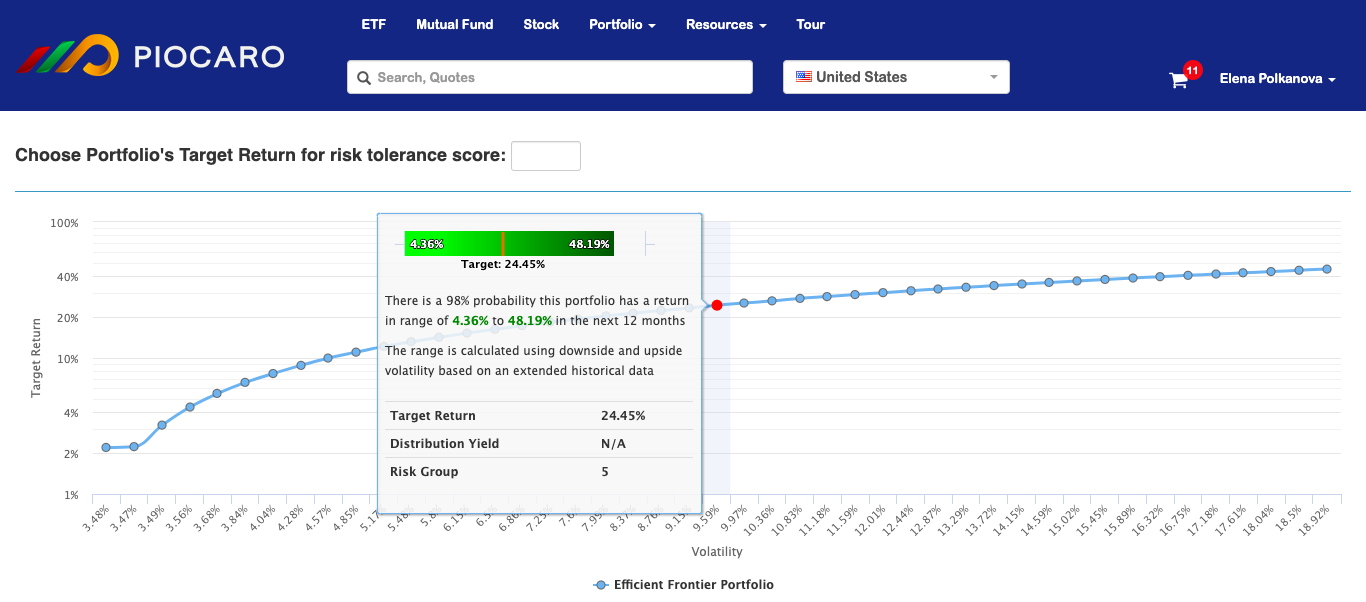

The resulting chart is called an Efficient Frontier. It is obtained by mapping all possible portfolios that can be designed from different combinations of the assets you have selected.

An Efficient frontier is a combination of portfolios that provide the highest possible return for a given level of risk. All optimal portfolios are located on the efficient frontier. All portfolios below the efficient frontier are called suboptimal because they do not generate enough return to compensate for risk.

Your current portfolio is marked as a black dot on the chart.

In this example, the portfolio is suboptimal. It does not compensate its investor with enough return for the risk. There are portfolios on the efficient frontier that offer higher return for the same or even lower level of risk. You can obtain more information about each portfolio by clicking on it. For each portfolio that you select Piocaro provides infographics that highlight the key features of the portfolio, including its risk and total return, allocation summary, asset weights and the portfolio's hypothetical performance.

By optimising your portfolio, Piocaro changes the composition of assets in your portfolio and the weights distribution. For example, some assets might be removed from your original portfolio as non-effective, while more effective assets receive more weight. You can compare your portfolio allocations with those of an efficient portfolio.

After you have decided to optimise your investment, save your portfolio:

-

Click Next and type in your Portfolio Name, Description and the Amount to Invest.

-

Click Save and review a summary of your investment with return targets, the risk levels, and asset allocations.

-

Click Download to obtain a summary of your investment portfolio. This is a PDF document that highlights the key features of your portfolio, and an Excel spreadsheet with asset allocations to send to your broker.

Optimised Portfolio Generator

To run the Optimized Portfolio Generator: On the main page, click Portfolio and select Optimised Portfolio Generator from the dropdown menu.

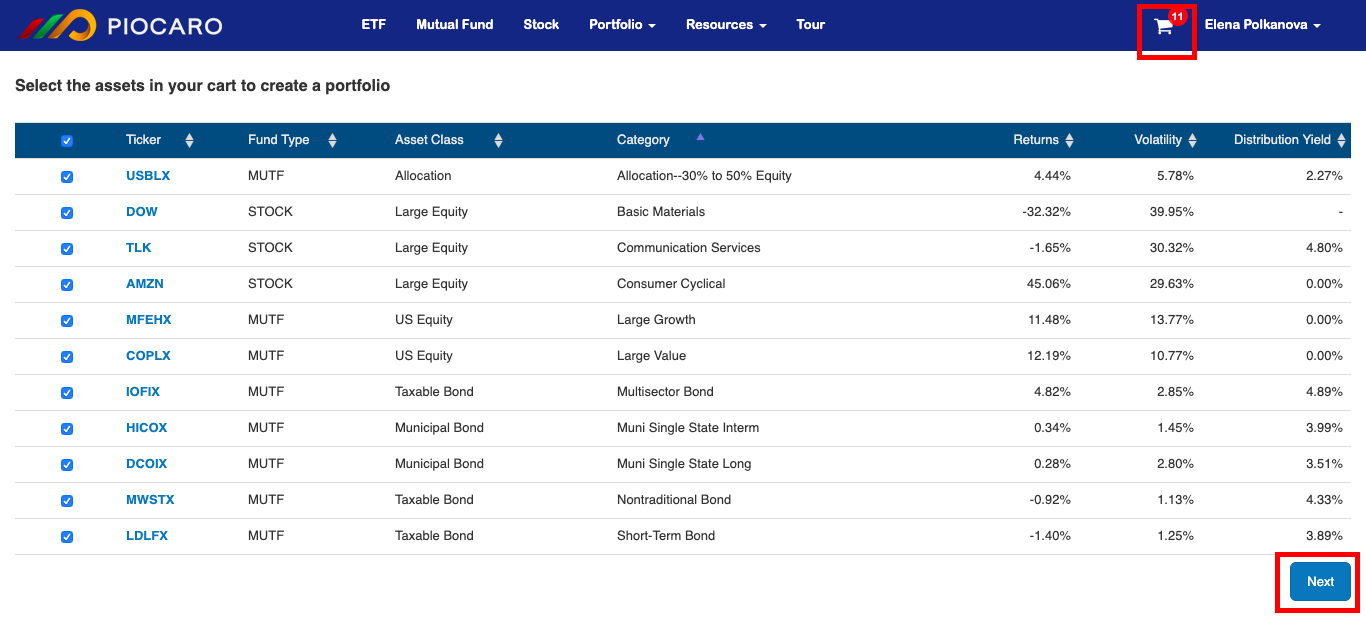

The Optimised Portfolio Generator enables you to create your own optimal portfolio based on the selection of assets in your Asset Cart.

Piocaro uses an Asset Cart to temporarily hold the pre-selected funds that are the foundation from which you build and optimise a portfolio. The Asset Cart icon looks like a shopping cart but the Asset Cart does not allow the buying and selling of securities - it is just a repository.

After you have added various assets to your Asset Cart, you can narrow your selections and optimise your portfolio. There are several ways Piocaro can help with this.

One of the main objectives of optimisation is to diversify a portfolio and thus reduce its overall risk. You get the most benefits from diversification if the assets you choose have negative or low correlation. Such assets react to market movements differently and the gains on one asset hedge you against loses on another.

Click the Asset Cart icon to view a correlation matrix based on the selection of assets in your portfolio.

Assets that are highly correlated (red areas) will move in the same direction and the portfolio will be more volatile and risky. To decide which of the correlated assets to exclude, you can compare them using table below the Correlation matrix. This table shows each asset's Returns, Volatility and Distribution Yield.

To exclude some assets from your cart, you can either click Edit Cart or leave the box opposite these assets empty. If you want to check how the correlation matrix will look after you have made some changes, click Edit Cart and then go back to your Asset Cart. You can also add assets when you edit your cart.

When you have made your final selection and all necessary changes, click Next to optimise your portfolio.

The result of optimisation is an Efficient Frontier.

An Efficient frontier is a combination of portfolios that provide the highest possible return for a given level of risk. All portfolios below the efficient frontier are called suboptimal because they do not generate enough return to compensate for risk. If you choose a portfolio that lies on the efficient frontier, you receive the best risk-return trade-off.

Based on your selection of assets, Piocaro creates a set of optimal portfolios located on the Efficient Frontier. Mouseover portfolios on the efficient frontier to view a brief summary of each portfolio's main characteristics such as its projected return range, target return, distribution yield and risk group (the lower the risk group value, the lower the portfolio overall risk).

Select a portfolio on the Efficient Frontier that best meets your goals to look at its key characteristics in more detail.

-

Benefit diversification

Diversification benefit reduces your portfolio's volatility without compromising the portfolio's expected return. This is possible when assets in your portfolio have less than a perfect positive correlation.

A portfolio's diversification benefit is calculated by taking the difference between the sum of weighted average risk of individual funds in the portfolio and the standard deviation of the portfolio. If you multiply each asset's volatility by the weight of this asset, you get total portfolio volatility. However, because assets in the portfolio are not perfectly correlated, the actual volatility will be smaller. The difference between calculated and actual volatility is called diversification benefit.

-

Allocation Model

Picaro uses three main Allocation Models: Growth, Balance and Income. A portfolio allocation model is determined based on the proportions of different asset classes it contains.

-

Growth: 60-100% equity, 40-0% other assets.

-

Balance: 40-60% equity, 40-60% other assets.

-

Income: 0-40% equity, 100-60% other assets.

-

After you have reviewed your options and decided, save your portfolio:

-

Click Next and type in your Portfolio Name, Description and the Amount to Invest.

-

Click Save and review a summary of your investment with return targets, the risk levels, and asset allocations.

-

Click Download to obtain a summary of your investment portfolio. This is a PDF document that highlights the key features of your portfolio, and an Excel spreadsheet with asset allocations to send to your broker.

Use the Portfolio Dashboard to view, download, edit or delete any of your portfolios.